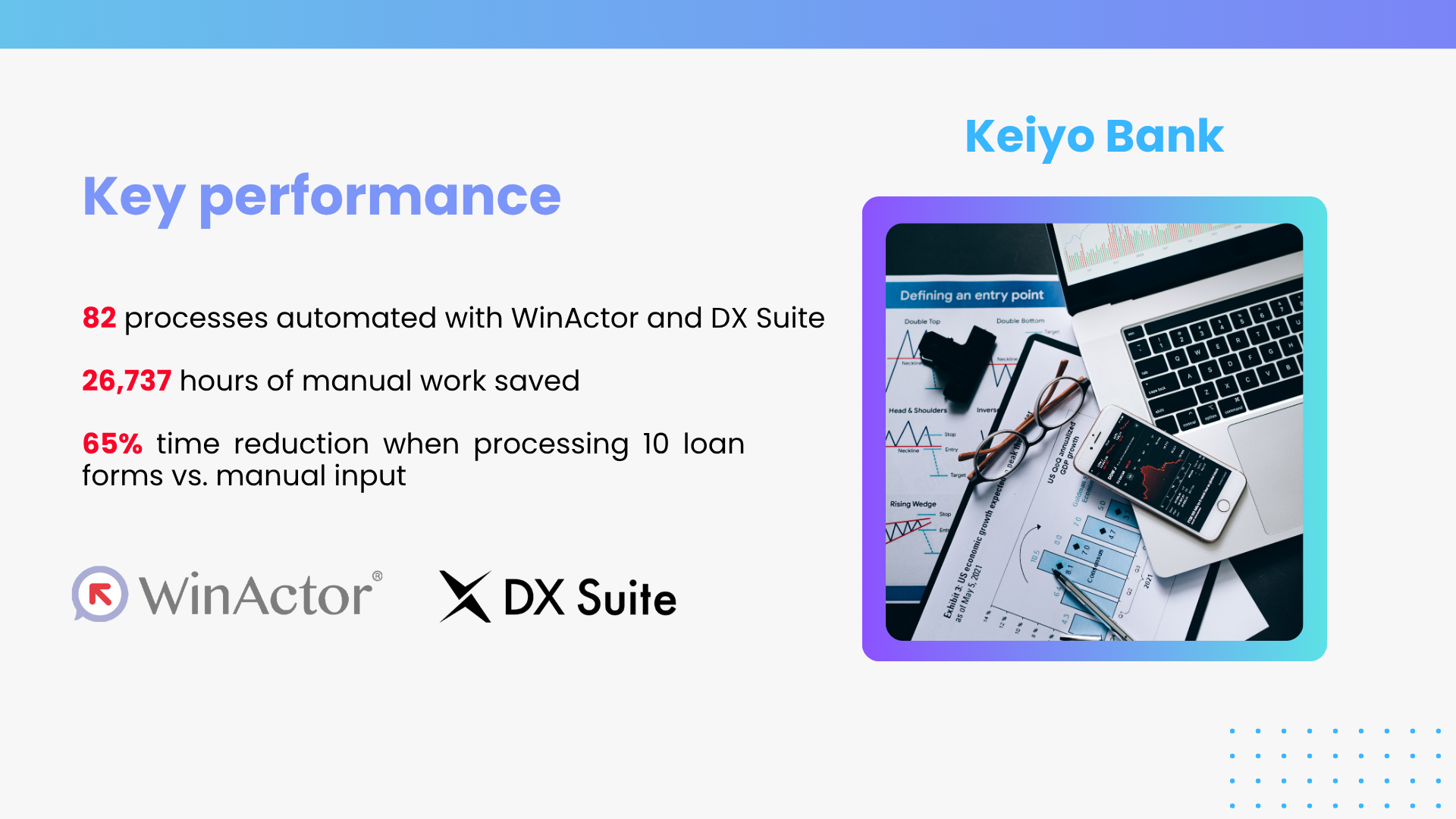

1. Overview of Keiyo Bank

Keiyo Bank (株式会社京葉銀行) is a regional bank based in Chiba Prefecture, Japan. With a strong focus on improving operational efficiency and strengthening its customer services, the bank has actively pursued digital transformation initiatives. One of its key efforts has been adopting Robotic Process Automation (RPA) and AI-based Optical Character Recognition (AI-OCR) solutions.

In 2018, Keiyo Bank began implementing the Japanese leading RPA tool, WinActor. By March 2021, the bank had automated 82 business processes, aiming to reduce workloads and enable staff to concentrate on customer-facing operations. Seeking further efficiencies, Keiyo Bank adopted the cloud-based AI-OCR service DX Suite, an AI solution developed by AI Insider in February 2020. Both WinActor and DXSuite are digital transformation solutions distributed by NTT Data Group.

2. Challenges

Before partnering with NTT Data, Keiyo faced numerous operational challenges.

Paper-Based Workflows Remained a Burden

Despite the bank’s earlier adoption of RPA, many processes, particularly in the housing loan department, still relied heavily on paper forms. Preliminary screening applications for housing loans continued to be submitted on paper, requiring manual data entry into the bank’s systems.

Additionally, in the inquiry department, the bank handled a vast number of paper-based transaction inquiries from government agencies and other organizations. The formats of these documents varied widely. Processing them involved manually checking documents, extracting required information, searching core systems, and compiling response reports.

Time-Consuming Manual Work

For a single housing loan application, manual input was slightly faster than using AI-OCR plus RPA. However, when processing ten applications, the bank’s measurements showed that automation reduced processing time by approximately 65% compared to manual handling.

The inquiry department’s manual processing took about 30 to 60 minutes per case due to the diversity and volume of paper forms.

These paper-based tasks placed a significant burden on branch staff and limited the bank’s ability to allocate resources toward sales activities and customer service.

Security Requirements for Cloud Use

Implementing cloud services in a financial institution raised concerns over the protection of sensitive customer data. Integrating AI-OCR, which involves uploading document images to the cloud, requires strict security measures to comply with industry regulations.

3. Solutions Implemented

WinActor RPA Deployment

Since 2018, Keiyo Bank has leveraged WinActor to develop RPA scenarios internally. This allowed the bank to automate various processes, including online application handling, system searches, and data entry. By March 2021, they had achieved automation of 82 business processes.

Toshihiro Kubota, IT Planning Group of Keiyo, shared:

“The introduction of RPA allows us to concentrate resources on tasks with added value. We believe that combining AI-OCR with RPA will further enhance the value of RPA scenarios. We’d like to keep refining our automation and extend it to even more operations.”

DX Suite deployment

In February 2020, Keiyo Bank implemented DX Suite, a cloud-based AI-OCR service running on AWS. The solution digitizes paper documents, transforming them into structured data with high recognition accuracy.

The bank initially applied DX Suite to digitize housing loan preliminary screening applications. Scanned images of paper forms were uploaded securely to DX Suite, where text was extracted and converted into structured data. This data was then entered automatically into core systems via WinActor.

Subsequently, DX Suite was extended to handle diverse forms in the inquiry department, extracting necessary fields for further automated processing.

Tatsuko Chanoki, IT Planning Group, said:

“Although there were hurdles, such as security measures, it was significant that we were able to solve them and proceed with the use of DX Suite in the cloud. Going forward, we’ll continue to look into expanding centralized processing, which has proven effective.”

Security Measures

Given the bank’s strict requirements, multiple steps were taken to ensure security:

- The bank reviewed DX Suite’s provider across more than 30 verification points, covering data center security, ID management, operational monitoring, and more.

- Access to the DX Suite was restricted to specific IP addresses within the bank’s thin-client environment, ensuring that data was transmitted and received only through secure channels.

- Traffic was monitored to detect anomalies, ensuring that any unauthorized activity could be identified quickly.

4. Implementation Process

Period 1: Pilot Testing: Combination with WinActor

DX Suite was first tested with housing loan applications. The results showed that although automation took slightly longer for single forms, significant time savings were realized when processing multiple documents in batches.

Period 2: Expansion to Other Departments

Encouraged by these results, Keiyo Bank expanded DX Suite to the inquiry department. The system extracted required information from various paper formats, enabling WinActor to handle tasks like system searches and report generation automatically.

Period 3: Centralized Processing

The bank adopted a model in which scanned documents from branches were processed centrally at headquarters, improving efficiency and reducing workloads at the branch level.

5. Results and Performance

Time Savings

Keiyo Bank reports a cumulative reduction of 26,737 hours in manual work across the 82 automated processes using WinActor and DX Suite.

Efficiency Gains

In high-volume cases, such as batches of 10 housing loan applications, processing time was reduced by about 65% compared to manual work.

Improved Work Allocation

By reducing repetitive tasks, the bank has freed up staff time, allowing branch employees to focus more on sales activities and customer interactions.

Security Compliance

Through stringent security checks and controlled access, Keiyo Bank successfully implemented cloud services while maintaining compliance with strict banking regulations.

Conclusion

Keiyo Bank’s journey demonstrates the transformative power of combining RPA and AI-OCR technologies. By integrating WinActor and DX Suite, the bank has achieved significant efficiency gains, reduced the burden of paper-based operations, and created more time for staff to engage in customer-oriented activities. Their success offers a strong example for other financial institutions seeking to balance innovation with security and operational excellence.

For organizations still grappling with time-consuming manual tasks and paperwork, Keiyo Bank’s story offers a blueprint for meaningful change. With the right tools and a clear vision, you too could be the next success, achieving greater efficiency, compliance, and customer satisfaction. Get a 30-day free trial of WinActor or consult our experts to become the next successful business!