In today’s financial sector, compliance and risk management are as critical as customer service. Banks must demonstrate to regulators that they understand their customers, prevent fraud, and provide accurate reports – tasks that necessitate handling vast amounts of data with precision. When managed manually, these processes are slow, prone to errors, and expensive.

Robotic Process Automation (RPA) is transforming this by automating repetitive, rule-based tasks, enabling banks to meet regulatory demands while enhancing efficiency and mitigating risk.

Why RPA Matters in Banking

Banking is highly regulated, and errors come at a high cost – both financially and in terms of reputation. Manual compliance processes often require large teams who spend countless hours transferring data between systems, checking regulatory lists, and preparing reports.

The problems are threefold:

- Error risk: Each manual data entry or cross-check increases the chance of mistakes, which can lead to fines or compliance breaches.

- Slow turnaround: Lengthy KYC checks or fraud reviews delay account openings, loan approvals, or transaction clearances, frustrating customers.

- Rising costs: Compliance spending is ballooning – global banks and fintechs now spend over $206 billion per year on financial crime compliance alone.

RPA addresses these issues because bots can log into systems, copy data, validate it, and apply pre-defined rules without fatigue or human bias. They complete work in minutes that would take employees hours, and they do it with higher accuracy.

1. RPA in KYC (Know Your Customer)

KYC is the first line of defense against money laundering and terrorism financing. Banks must collect personal documents, verify their authenticity, and compare customer identities against sanctions and watchlists.

Why manual KYC is a burden:

- A single KYC review costs banks an average of $2,211, and large institutions spend up to $30 million annually on KYC alone.

- Client onboarding can stretch for weeks – more than half of institutions report review times of 61–150 days.

- Regulators impose heavy fines if checks are incomplete; some banks have paid penalties of $100 million+ for inadequate programs.

How RPA transforms KYC:

- Automated document handling: Bots extract data from IDs and utility bills, validate it, and populate it into core systems without human re-entry.

- Sanctions and PEP list screening: Bots automatically cross-check against AML and PEP databases to ensure compliance.

- Audit trails: Every step is logged, making it easier to prove compliance during regulator audits.

For example, when global banks like HSBC automated KYC checks, onboarding time dropped by more than 50%. This improvement not only lowered compliance costs but also made the customer experience faster and smoother.

2. RPA in Fraud Detection

Fraud prevention relies on analyzing vast transaction volumes to detect suspicious activity, from unusual payment patterns to account takeovers. Manual teams struggle to keep pace, and delays in detection can mean millions in losses.

Why manual fraud detection falls short:

- Fraud is expensive: the average cost per fraud incident for a financial institution is $4.3 million, considering losses, investigations, and penalties.

- Canadian banks reported that for every $1 lost to fraud, they now incur an additional $4.45 in costs.

- Manual monitoring generates high false positives, overwhelming analysts and delaying the investigation of real threats.

How RPA improves fraud detection:

- Real-time monitoring: Bots apply red-flag rules to transactions instantly, so suspicious behavior doesn’t go unnoticed.

- Automated escalation: Alerts are routed directly to investigators, cutting the lag time between detection and action.

- Integration with AI: While RPA handles structured, rules-based checks, it can trigger AI models to analyze anomalies and detect subtle fraud patterns.

Banks like JPMorgan Chase have combined RPA and AI for fraud prevention, saving millions by reducing both false positives and fraudulent losses.

3. RPA in Regulatory Reporting

Banks must submit detailed reports to regulators such as the SEC, FCA, or central banks, often under tight timelines. Reports require consolidating structured and unstructured data across multiple departments.

Why manual reporting is risky:

- Large banks spend an average of $60 million annually on KYC and compliance programs, much of it tied to reporting labor.

- Manual reporting is time-consuming and inconsistent, creating risks of regulatory penalties.

- Late or incorrect filings can lead to multi-million-dollar fines and damaged reputations.

How RPA ensures compliance:

- Data aggregation: Bots gather information from CRMs, payment systems, and risk platforms, eliminating silos.

- Validation rules: Figures are checked for consistency before submission, reducing human error.

- On-time delivery: Automated scheduling ensures reports are filed before deadlines, avoiding penalties.

When UBS automated MiFID II reporting in Europe, manual effort dropped significantly, while the accuracy and reliability of reports increased, strengthening trust with regulators.

Looking Ahead: From Automation to Intelligence

Banks are no longer stopping at using RPA just to handle repetitive tasks. As data volumes grow exponentially, transactions become more sophisticated, and regulatory requirements tighten, the financial sector is moving toward the next step: intelligent automation – the integration of RPA with technologies such as AI, Machine Learning, and advanced analytics.

Suppose RPA serves as the “hands,” helping banks save time and reduce human error in manual operations. In that case, AI acts as the “brain,” enabling systems to become increasingly smarter and more adaptive. By combining the two, banks can not only process information faster but also make better decisions and proactively mitigate risks before they materialize.

Some prominent applications of this trend include:

- KYC + AI: Intelligent document processing reads handwritten forms or poor-quality scans.

- Fraud + Machine Learning: AI models detect subtle fraud, while RPA executes the workflows.

- Reporting + NLP: Natural language processing interprets narrative data, while bots structure it for compliance.

This evolution, known as intelligent automation, helps banks keep up with growing regulatory demands while reducing compliance costs.

Why WinActor for Banking Automation?

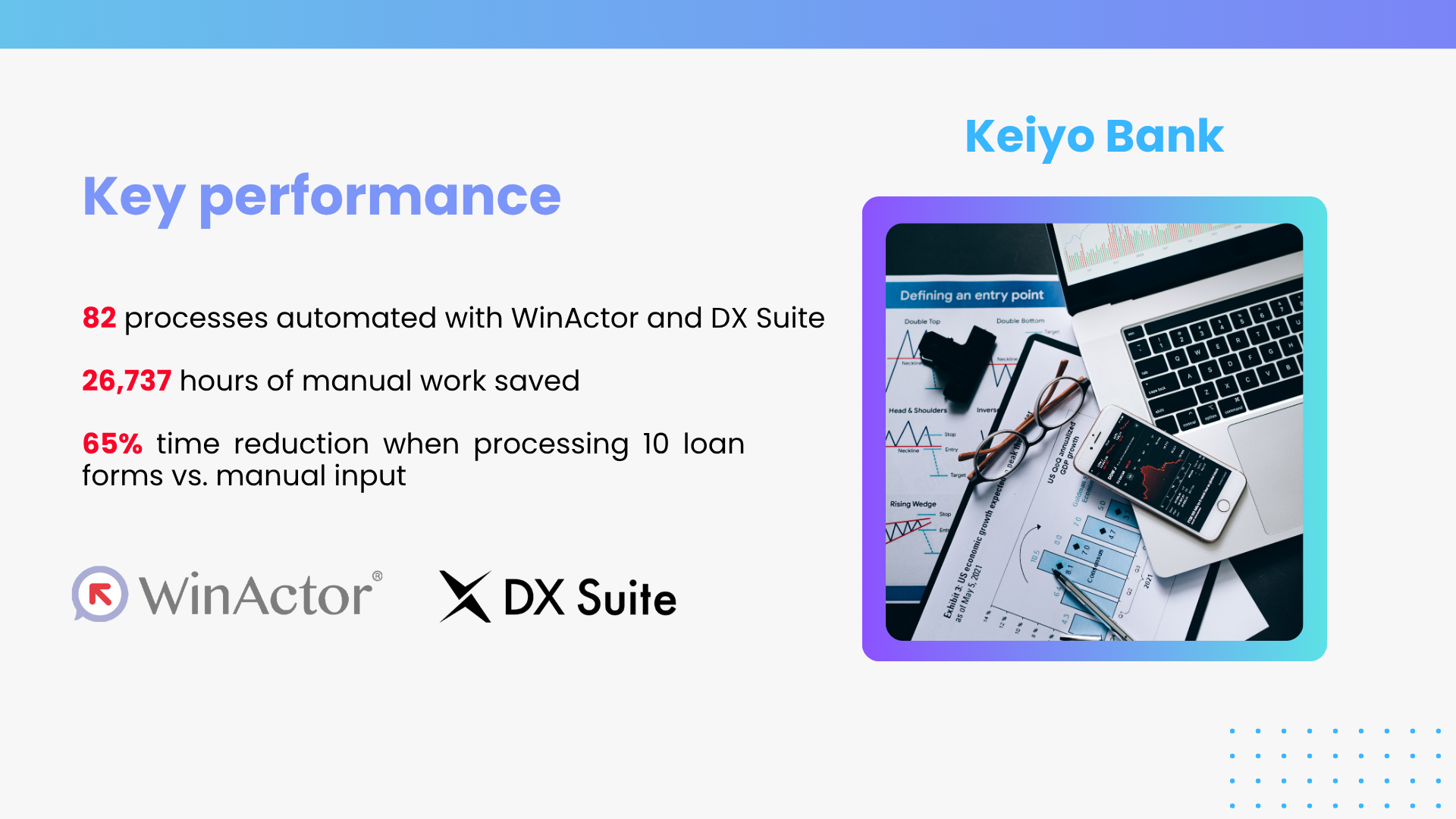

Provided by NTT DATA, WinActor is Japan’s No.1 RPA tool and widely adopted in financial services. Its design addresses the specific needs of compliance-heavy industries like banking:

- End-to-end KYC automation: WinActor bots extract and validate data against sanctioned databases and update records across systems. This can cut onboarding time by up to 70% while ensuring compliance proof.

- Integrated fraud workflows: WinActor connects with monitoring systems to flag transactions and escalate cases immediately, reducing analyst overload and speeding fraud response.

- Compliant reporting: With built-in connectors and templates, WinActor automates data gathering and formatting for filings, lowering the risk of fines for late or incorrect reports.

By targeting the exact areas where compliance costs are highest – KYC reviews, fraud monitoring, and regulatory filings – WinActor helps banks reduce costs, mitigate risk, and deliver faster, safer services.

Start a free trial or contact us today to discover how WinActor can support your bank’s compliance and risk management strategy in banking.